What Is A Get Tax In Hawaii . how to calculate the get, tat & otat on hawaii rental income. the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. this tax facts answers basic questions about how the general excise tax (get) and use tax applies to manufacturers and producers. The get tax in hawaii is assessed on. What is the general excise tax (get)? general excise tax (get) this tax facts answers common get questions. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. Businesses are subject to get on their gross receipts. The get is a privilege tax imposed on business activity in the state of hawaii. Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. instead of implementing a sales tax, hawaii uses a general excise tax (get).

from kauaipropertysearch.com

instead of implementing a sales tax, hawaii uses a general excise tax (get). The get tax in hawaii is assessed on. Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. What is the general excise tax (get)? the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. The get is a privilege tax imposed on business activity in the state of hawaii. how to calculate the get, tat & otat on hawaii rental income. general excise tax (get) this tax facts answers common get questions. this tax facts answers basic questions about how the general excise tax (get) and use tax applies to manufacturers and producers.

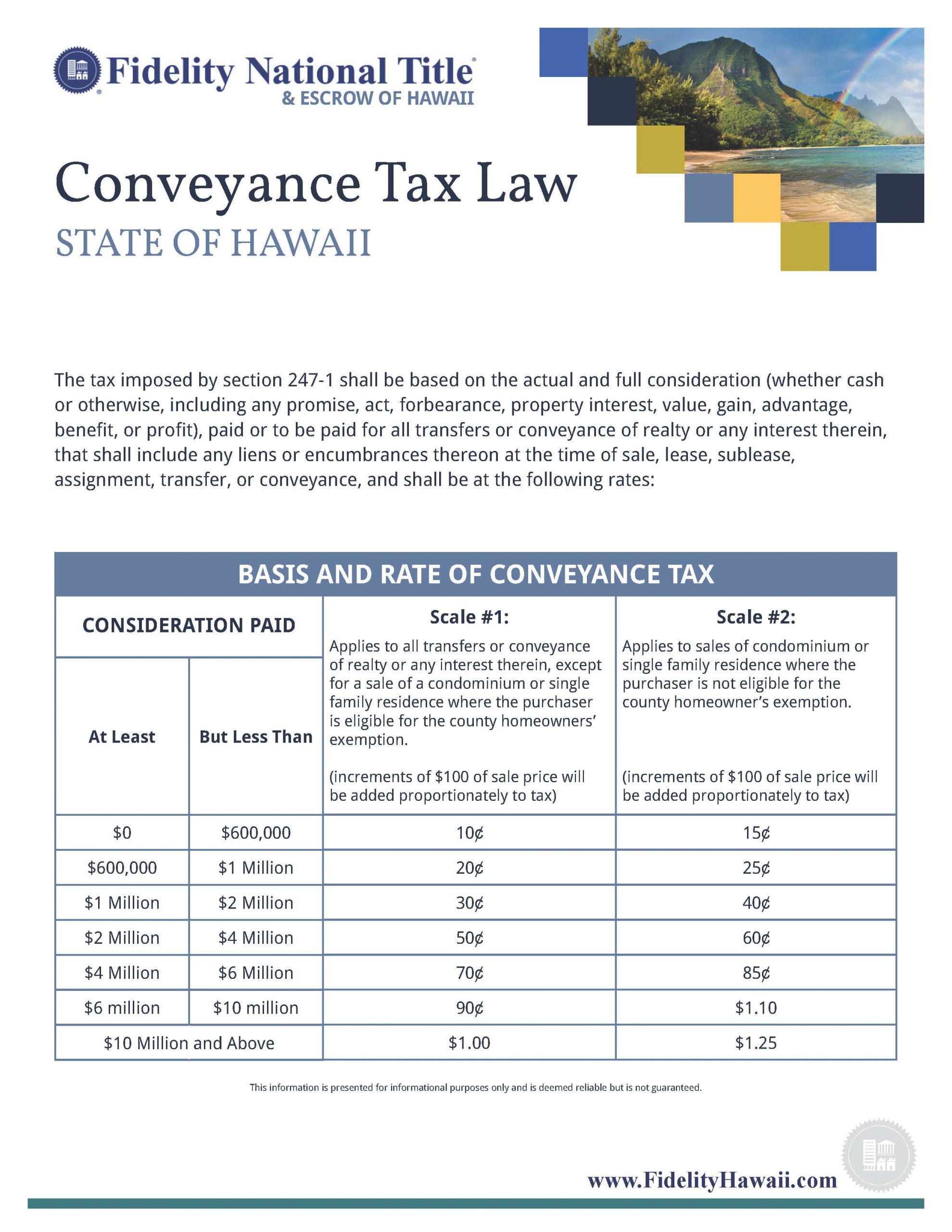

Hawaii Conventance Tax Kauai Real Estate Search

What Is A Get Tax In Hawaii Businesses are subject to get on their gross receipts. The get is a privilege tax imposed on business activity in the state of hawaii. how to calculate the get, tat & otat on hawaii rental income. The get tax in hawaii is assessed on. this tax facts answers basic questions about how the general excise tax (get) and use tax applies to manufacturers and producers. instead of implementing a sales tax, hawaii uses a general excise tax (get). Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. What is the general excise tax (get)? general excise tax (get) this tax facts answers common get questions. Businesses are subject to get on their gross receipts.

From myxora.com

Cost Of Living In Hawaii 2022 Your Handy Guide (2022) What Is A Get Tax In Hawaii the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. this tax facts answers basic questions. What Is A Get Tax In Hawaii.

From www.taxsolutionslawyer.com

Economic Nexus, Hawaii General Excise Tax, And Providing Services In What Is A Get Tax In Hawaii the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. general excise tax (get) this tax facts answers common get questions. how to calculate the get, tat & otat on hawaii rental income. The get tax in hawaii is assessed on. this tax facts answers basic questions about how the general excise. What Is A Get Tax In Hawaii.

From islandtaxcalculator.blogspot.com

Hawaii General Excise Tax Id Number What Is A Get Tax In Hawaii the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. What is the general excise tax (get)? Businesses are subject to get on their gross receipts. Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. instead of implementing a sales tax, hawaii uses a general excise tax (get). how. What Is A Get Tax In Hawaii.

From ags.hawaii.gov

Hawaii Information Portal How To Get Your Wage and Tax Statement (W2) What Is A Get Tax In Hawaii hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. how to calculate the get, tat & otat on hawaii rental income. The get is a privilege tax imposed on business activity in the state of hawaii. general excise tax (get) this tax. What Is A Get Tax In Hawaii.

From howtostartanllc.com

Hawaii General Excise Tax Small Business Guide TRUiC What Is A Get Tax In Hawaii Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. general excise tax (get) this tax facts answers common get questions. The get is a privilege tax imposed on business activity in the state of hawaii. how to calculate the get, tat & otat on hawaii rental income. instead of implementing a sales tax,. What Is A Get Tax In Hawaii.

From hawaiibloggen.se

Sales Tax i Hawaii Hawaiibloggen What Is A Get Tax In Hawaii this tax facts answers basic questions about how the general excise tax (get) and use tax applies to manufacturers and producers. general excise tax (get) this tax facts answers common get questions. how to calculate the get, tat & otat on hawaii rental income. hawaii general excise tax is an additional tax (totally in addition to. What Is A Get Tax In Hawaii.

From thetaxvalet.com

How to File and Pay Sales Tax in Hawaii TaxValet What Is A Get Tax In Hawaii Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. general excise tax (get) this tax facts answers common get questions. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. the tax rate is 0.15% for insurance commission, 0.5%. What Is A Get Tax In Hawaii.

From tax.modifiyegaraj.com

How To Get A Hawaii State Tax Id Number TAX What Is A Get Tax In Hawaii The get is a privilege tax imposed on business activity in the state of hawaii. What is the general excise tax (get)? instead of implementing a sales tax, hawaii uses a general excise tax (get). the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. Businesses are subject to get on their gross receipts.. What Is A Get Tax In Hawaii.

From formspal.com

Hawaii Tax Form Bb1X ≡ Fill Out Printable PDF Forms Online What Is A Get Tax In Hawaii how to calculate the get, tat & otat on hawaii rental income. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. What is the general excise tax (get)? The get is a privilege tax imposed on business activity in the state of hawaii.. What Is A Get Tax In Hawaii.

From itep.org

Hawaii Who Pays? 6th Edition ITEP What Is A Get Tax In Hawaii Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. instead of implementing a sales tax, hawaii uses a general excise tax (get). Businesses are subject to get on their gross receipts. this tax facts answers basic questions about how the general excise tax (get) and use tax applies to manufacturers and producers. hawaii. What Is A Get Tax In Hawaii.

From movetohawaii365.com

Hawaii Property Taxes Surprising Facts You Should Know Move To What Is A Get Tax In Hawaii instead of implementing a sales tax, hawaii uses a general excise tax (get). how to calculate the get, tat & otat on hawaii rental income. general excise tax (get) this tax facts answers common get questions. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross. What Is A Get Tax In Hawaii.

From www.dochub.com

Hawaii state tax forms 2022 Fill out & sign online DocHub What Is A Get Tax In Hawaii Businesses are subject to get on their gross receipts. Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. how to calculate the get, tat & otat on hawaii rental income. What is the general excise tax (get)? The get is. What Is A Get Tax In Hawaii.

From docs.stripe.com

Collect tax in Hawaii Stripe Documentation What Is A Get Tax In Hawaii The get tax in hawaii is assessed on. What is the general excise tax (get)? The get is a privilege tax imposed on business activity in the state of hawaii. Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. hawaii general excise tax is an additional tax (totally in addition to federal and state income. What Is A Get Tax In Hawaii.

From thepapakeacollection.com

Understanding the Tax Map Key (TMK) System in Hawaii What Is A Get Tax In Hawaii Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. instead of implementing a sales tax, hawaii uses a general excise tax (get). the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. general excise tax (get) this tax facts answers common get questions. The get is a privilege tax. What Is A Get Tax In Hawaii.

From www.youtube.com

Hawaii Tax Debt Getting Started YouTube What Is A Get Tax In Hawaii The get is a privilege tax imposed on business activity in the state of hawaii. The get tax in hawaii is assessed on. Get is 4.5% (oahu) based on the “ge taxable income.” the ge taxable. how to calculate the get, tat & otat on hawaii rental income. What is the general excise tax (get)? hawaii general excise. What Is A Get Tax In Hawaii.

From www.hawaiigifts.com

Taxes of Hawaii 2019 What Is A Get Tax In Hawaii the tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale. instead of implementing a sales tax, hawaii uses a general excise tax (get). how to calculate the get, tat & otat on hawaii rental income. this tax facts answers basic questions about how the general excise tax (get) and use tax applies. What Is A Get Tax In Hawaii.

From us.icalculator.com

Hawaii Sales Tax Rates US iCalculator™ What Is A Get Tax In Hawaii What is the general excise tax (get)? hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. this tax facts answers basic questions about how the general excise tax (get) and use tax applies to manufacturers and producers. general excise tax (get) this. What Is A Get Tax In Hawaii.

From www.grassrootinstitute.org

What is Hawaii’s general excise tax? Grassroot Institute of Hawaii What Is A Get Tax In Hawaii general excise tax (get) this tax facts answers common get questions. how to calculate the get, tat & otat on hawaii rental income. Businesses are subject to get on their gross receipts. hawaii general excise tax is an additional tax (totally in addition to federal and state income tax) on the gross income of most hawaii. What. What Is A Get Tax In Hawaii.